KLSE TECH REVIEW

Here's the link for my last month's market sense: Aboi's Updates for November 2014

For those who find it hard to follow I suggest reading through my previous posting on how I am using technical indicators as a trend seeker.

Recap - November's commentary.

What a month it has been. Though I did foresee a small sell off due to technical signs of weakness - refer to last month's. But really nobody had it coming. The magnitude of the fall of the oil price triggered a massive outflow of foreign capital from our O&G counters and subsequently also lead to the weakening of the MYR. My support line of 1840 was easily breached in the month of November but the sell off looks like it has bottomed as Bursa is slowly recovering as of this post.

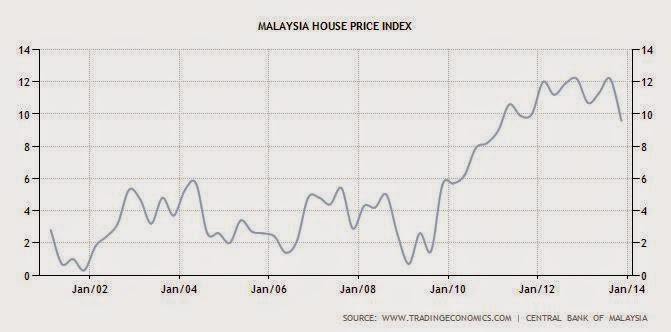

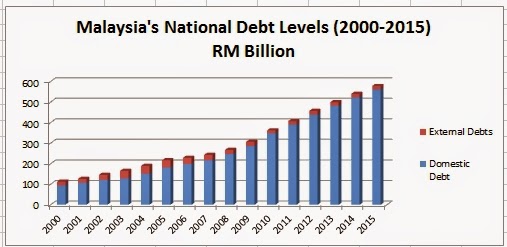

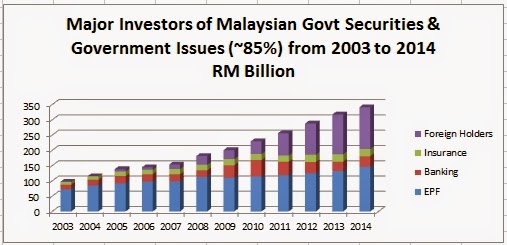

With oil expected to remain this low due to the supply glut with both American Shale oil producers and the Gulf producers not backing down production anytime soon. With MYR weakening, our inflationary pressures will worsen due to higher cost of imports. This is further compounded with GST coming in at 6% in April 2015. As inflation goes up, Bank Negara will only have two real options. [1] sell foreign reserves to support MYR [2] raise interest rates. The first option is only temporarily as we only have sufficient amount for 7.9 months of imports. The second will hit us hard as Malaysia's household debt to income ratio is already at a staggering 190%. NPL will surge and our banking system will weaken. Take Russia for example it raised interest rate from 11.5% to 17% in a single night to support its falling currency.

Because I do not believe that 2015 will be a good financial year for Malaysia I will spend more of my efforts to diversify globally and will need to do it anyway due to the need for portfolio rebalancing. I will set a new resistance of 1810 and support line of 1700 for the month of January.

Key economic news and market update from AMP Capital's economic update (FoC, updated every Friday):

1. US Central Bank signalling low US interest rate will prevail until at least April 2015.

2. Russia in full fledged economic crisis as Russian rubble (their currency) collapsed and interest rate was raised from 11.5% to 17% in December due to 40% fall in oil price and sanctions from US and Europe.

3. Shinzo Abe won re-election in Japan and has consolidated power by winning 2/3 of the lower house. He has vowed to redouble his efforts to kick start Japan's economy. Third arrow please.

4. US midterm elections. Republicans took over the House and the Senate. Will this mean more divided government because the president is a democrat? Likely so. Obama is heading to be a lame duck president for his remaining 2 years.

Portfolio - minus 2.89% vs minus 5% KLSE Index

Again market sell off has hit my portfolio just after it recovered in November this time due to foreign capital outflows. Nevertheless I am adamant, as data suggests local institutions are supporting the market as of this post. Supermax was the hardest hit from rm2.35 to rm1.65 - backed by news that the CEO is charged for insider trading. Read more. Knee jerk reaction as Supermax is still business as usual. I will blog about this in January 2015.

My foreign investments are holding strong, providing crucial support when the local market was tanking as evident that my portfolio only lost 2.89% of its value vs KLSE index at 5%. As mentioned I further diversified when I placed an initial investment into a PRS fund. Private Retirement Schemes in Malaysia Part 2. I plan to triple my current exposure inside this fund in 2015. The shining metal - gold is stubbornly holding ground near $1200, still slightly above my target price. Continue to monitor and wait.

I am waiting for my Dynaquest Stock Performance Guide Sept 2014 to arrive and I will restart my posts on stock analysis particularly Padini and MREITs.

PORTFOLIO REVIEW

|

Portfolio target composition. Equities 65%, Bonds 25% and Supplementary 10%.

Targets for returns p.a. Equities 12%, Bonds 5% and Supplementary 3.5%.

|

Notes

-Added CIMB-Principal PRS Plus Asia Pacific Ex Japan Fund (under Mutual Funds) with a BUY rating.

-Added CIMB-Principal PRS Plus Asia Pacific Ex Japan Fund (under Mutual Funds) with a BUY rating.

Comments

#1 Portfolio target for the fourth portfolio year @ RM140k for April 2014 has already EXCEEDED. Portfolio target for the fifth portfolio year @ RM152k for April 2015. The TWRR (time weighted annual return rate is now at 8.18% (down 0.98% from Nov'14) vs my target of 9.40%).

Disclaimer: The reports, analysis and recommendations in this blog are solely my personal views. I do not link to any investment body or company. As such, I will not be responsible of any of your investment decision. Consult your investment adviser or come to your own conclusions before making any investment decision.